In recent years, Islamic banking has gained significant traction across the United States. With the rise of ethical and interest-free financial solutions, more individuals and businesses are turning to banks for their financial needs. This article explores the top benefits of choosing an Islamic bank in USA and how these institutions align with Islamic financial principles..

Table of Contents

Understanding Islamic Banking

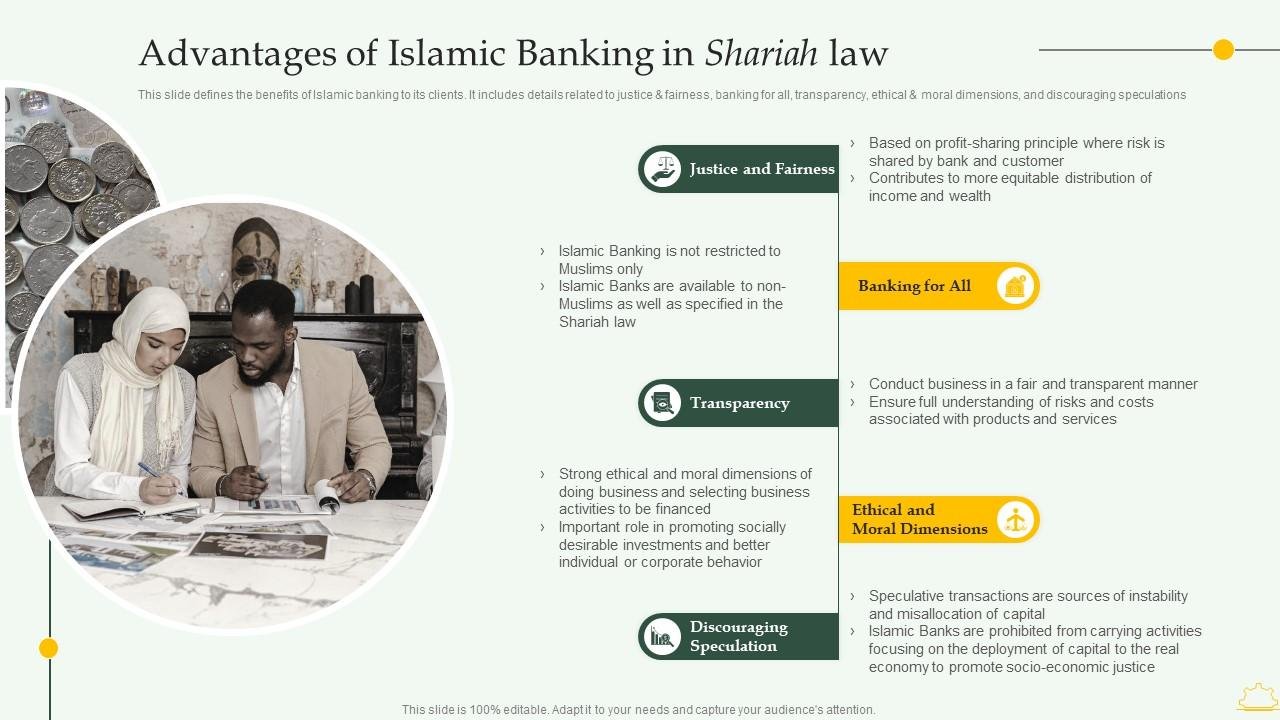

banking follows Shariah law, which prohibits interest (riba) and encourages ethical investments. The core principles include risk-sharing, profit-sharing, and asset-backed financing, making it a viable alternative to conventional banking.

How Does an Bank in USA Work?

banks operate on profit-sharing models rather than charging interest. They invest in halal (permissible) ventures and provide financial solutions that comply with Islamic guidelines.

1. Interest-Free Financial Services

One of the key benefits of an bank in USA is its commitment to interest-free banking. Instead of charging or paying interest, these banks utilize profit-sharing agreements and Islamic contracts such as Murabaha, Ijarah, and Mudaraba.

Murabaha (Cost-Plus Financing)

This contract involves the bank purchasing an asset and selling it to the customer at a profit, with payments made in installments.

Ijarah (Leasing)

The bank purchases an asset and leases it to the customer for a fixed period, ensuring compliance with Islamic finance principles.

2. Ethical and Halal Investments

banks invest only in ethical and Shariah-compliant businesses. This means no involvement in industries such as alcohol, gambling, or speculative trading.

Socially Responsible Banking

Customers can rest assured that their money is being used in businesses that align with their religious and ethical beliefs.

3. Risk-Sharing Model

banking operates on risk-sharing principles, where both the bank and the customer share profits and losses.

Mudaraba (Profit-Sharing)

A partnership where one party provides the capital, and the other offers expertise, with profits shared based on pre-agreed ratios.

Musharaka (Joint Venture)

Both parties contribute capital and share profits and losses proportionally.

4. Financial Stability and Transparency

Islamic banks avoid excessive risk and speculation, ensuring a more stable financial environment.

Asset-Backed Financing

banks finance only tangible assets, reducing the chances of financial crises caused by speculative trading.

Transparent Transactions

Contracts are clear, with well-defined profit-sharing mechanisms and no hidden fees.

5. Inclusive Banking Services

banks cater to both Muslim and non-Muslim customers looking for ethical financial solutions.

Personal and Business Banking

banks offer a wide range of services, including savings accounts, home financing, business loans, and investment options.

How to Choose the Best Islamic Bank in USA?

When selecting an Islamic bank, consider factors such as:

- Shariah Compliance: Ensure the bank follows strict banking principles.

- Product Offerings: Look for diverse financial products that meet your needs.

- Reputation: Choose a bank with a strong track record in ethical banking.

FAQs About Islamic Banks in the USA

1. Are Islamic banks in the USA regulated?

Yes, Islamic banks in the USA operate under federal and state banking regulations while adhering to Islamic finance principles.

2. Can non-Muslims use banking services?

Absolutely! banking is open to anyone seeking ethical and interest-free financial solutions.

3. How does home financing work in an bank?

Islamic banks use Shariah-compliant financing models like Murabaha or Ijara, where they purchase the home and lease or sell it to the customer at an agreed profit margin.

4. Do banks offer business loans?

Yes, banks provide business financing based on profit-sharing models such as Mudaraba and Musharaka.

5. Is Islamic banking more expensive than conventional banking?

Islamic banking operates on fair and transparent principles, and while costs may vary, they are competitive with conventional banking services.

Conclusion

Choosing an Islamic bank in USA provides numerous benefits, including ethical banking, interest-free financial solutions, and risk-sharing models. Whether you’re looking for personal banking services or business financing, banks offer a stable and Shariah-compliant alternative to conventional banking. Consider exploring banking today for a more ethical and transparent financial experience.