1. Introduction: The Enduring Relevance of Mailed Checks

In the rapidly evolving world of digital finance, where payment apps and wire transfers dominate headlines, one might assume that paper checks have become obsolete. However, for many businesses, first-class check mailing remains a crucial element of their financial operations. Why? Because it combines three critical advantages—speed, security, and savings—into one efficient and dependable solution. Whether you’re issuing payroll, vendor payments, or refunds, first-class-check-mailing still delivers powerful value in today’s hybrid financial environment.

Table of Contents

2. Speed: Not Just “Snail Mail” Anymore

The misconception that mailed checks are slow is outdated. First-class mail from the United States Postal Service (USPS) typically delivers within 1 to 5 business days, making it a fast and predictable option for nationwide correspondence. For many businesses, this level of reliability is more than sufficient for operational payments. Moreover, advanced mailing services and check processing systems have drastically reduced internal delays. Automated check printing and mailing can be done within 24 hours of issuing a payment, closing the time gap between issuance and delivery significantly.

3. Secure by Design: Why Checks Are Still Safe

Security is a top concern in any financial transaction, and physical checks offer built-in safety features that continue to make them a preferred choice. Most business checks include multiple layers of protection—from microtext and heat-sensitive ink to watermarks and secure seals. When combined with tamper-evident envelopes and controlled mailing workflows, first-class check mailing provides a strong defense against fraud. Unlike digital payment systems that are vulnerable to phishing and hacking, mailed checks operate in a more secure, less digitally exposed space.

4. Cost Efficiency: Lower Fees, Greater Control

One of the most overlooked benefits of first-class check mailing is cost savings. While electronic transfers and wire payments come with transaction fees that can quickly add up, mailing a check via first-class postage is relatively inexpensive—especially at scale. Businesses can also benefit from predictable budgeting for check-related expenses, including printing, postage, and processing. When checks are outsourced to third-party mailing services, companies can often achieve even greater cost efficiency through bulk mailing discounts and reduced labor costs.

5. Supporting a Diverse Payee Base

Not every recipient of a business payment has access to or interest in digital banking. Many vendors, contractors, and individuals—particularly in rural areas or older demographics—prefer or require physical checks. First-class mailing ensures you can serve this population reliably without forcing them into unfamiliar or inaccessible platforms. Offering checks also reflects a business’s flexibility and consideration, which can strengthen relationships and foster trust. For legal and tax-related payments, mailed checks are often the safest and most universally accepted option.

6. Tracking, Auditing, and Record-Keeping Benefits

First-class check mailing supports strong internal controls. Mailed checks are tangible, trackable, and easy to reconcile. USPS offers optional services such as Certified Mail, Return Receipt, and tracking, which enhance visibility and provide proof of delivery. Even without those, businesses can implement internal logs and workflows that document each step of the process—from printing to mailing to deposit. This clear paper trail simplifies audits, eases accounting reconciliation, and serves as evidence in the event of payment disputes or fraud claims.

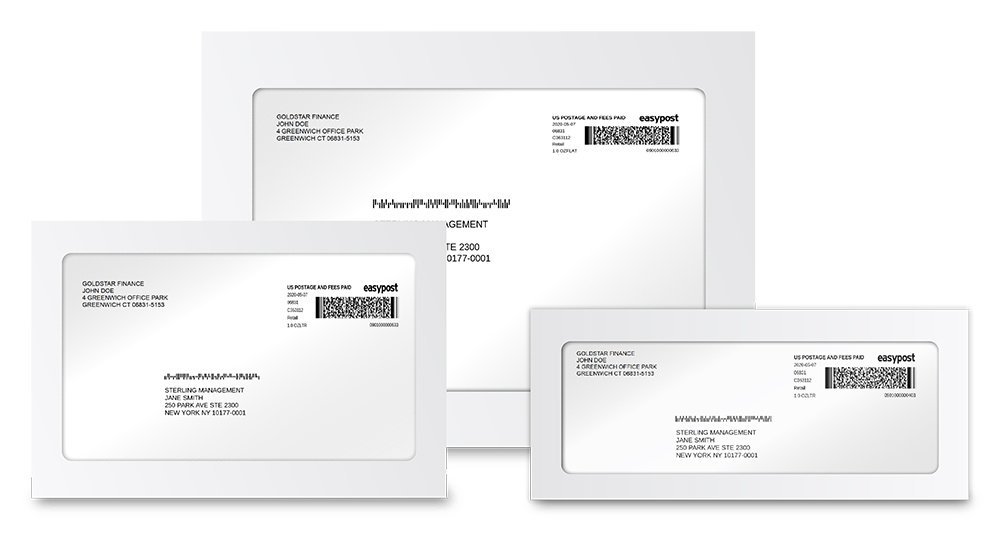

7. Integration with Modern Financial Systems

First-class check mailing doesn’t mean manual labor. Many businesses today use automated systems that integrate check printing and mailing directly with their accounting or ERP platforms. These systems can generate checks from digital data, apply custom templates, and send them to professional mailing centers for same-day dispatch. By combining traditional check delivery with digital tools, businesses enjoy the best of both worlds: the familiarity and flexibility of checks, along with the speed and automation of modern finance technology.

8. When to Choose First-Class Over Digital Payments

There are situations where first-class check mailing simply makes more sense than digital alternatives. For instance, when a payment must include supporting documentation (like an invoice summary or explanation of benefits), mailing a physical packet is more effective. Additionally, legal settlements, court-ordered disbursements, and certain insurance refunds often require checks for compliance and traceability. For businesses that deal with sensitive payments, such as healthcare providers or nonprofits, mailed checks can offer both discretion and formality that digital methods lack.

9. Conclusion: A Timeless Tool in a Digital Era

While fintech continues to revolutionize business finance, the practical advantages of first-class check mailing remain impossible to ignore. Combining speed, security, and cost-effectiveness, it’s a time-tested solution that still meets modern demands. By embracing automation, maintaining strong mailing protocols, and understanding when checks are the better option, businesses can operate with greater agility and accountability. In a world where flexibility is king, first-class-check-mailing proves that sometimes, the old way is still the smart way.