As the digital asset market continues to expand its reach into new industries, the discussion continues to transition from the question of whether cryptocurrency has staying power to whether or not its infrastructure offers support for long-term use. With this transition, the functionality of the crypto trading platforms themselves, particularly platforms designed with user functionality, analytics, and customizability, has begun to garner more attention. Whether a developer is trying to create new integrations or an everyday trader is trying to watch the price action, the landscape favors platforms that offer more than the ability to trade. The need now is for environments that provide real-time tools, secure storage, and efficient user interfaces in one ecosystem.

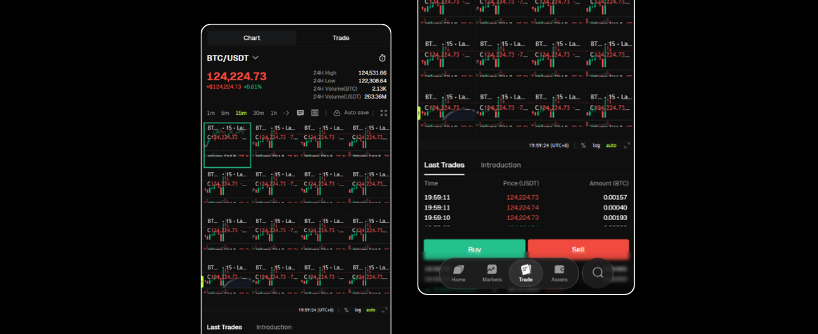

Bitunix, a cryptocurrency exchange platform founded in 2021, has structured much of its growth around this approach. While its initial emphasis was on derivatives, the company has since expanded its service offering with features aimed at both casual and professional users. One of the more distinctive developments in its lineup is the Bitunix Pro mobile application for Android. Designed to support real-time portfolio management, this app allows users to simultaneously monitor up to 16 charts at once. The 16-chart display is particularly notable for traders who operate across multiple time frames or asset pairs, offering a condensed but detailed view of market movement without the need to toggle between tabs or apps.

The platform also features a trading interface known as K-Line Ultra, which integrates more advanced charting with enhanced visual tracking. The K-Line Ultra is structured to provide a deeper level of price behavior analysis, allowing users to identify patterns, breakouts, or trends more effectively. This tool aligns with the larger demand in the industry for improved on-screen technical indicators, something that has become a benchmark of serious trading environments.

Beyond its user interface, the company has introduced mechanisms intended to provide diversified trading and investing options. One such addition is Bitunix’s implementation of performance-based copy trading. This feature allows users to replicate the trades of high-performing individuals, with a fee model tied to the actual returns generated. Rather than relying on flat subscription pricing, performance-based copy trading creates a structure where traders earn based on their results. It also introduces transparency, since followers can assess past performance data before deciding who to copy.

Another key area is the Bitunix Earn program, which extends the platform’s reach beyond active trading and into the passive income category. The Earn platform includes flexible savings, fixed-term products, and dual investment strategies. In its flexible savings model, interest is accumulated hourly and can be withdrawn without a holding period. This model has been used by retail users seeking liquidity without giving up yield potential. The fixed-term products, on the other hand, offer a more stable interest rate over set durations, ranging from one to four weeks.

Dual investment products within Earn are structured to allow users to commit to market direction without directly holding the underlying asset. These options work by locking in a return based on whether a target price is hit, offering a more calculated form of exposure that blends strategy and passive income. While not unique to Bitunix, the inclusion of this model reflects a broader market movement toward options-based investments packaged in user-friendly formats.

From a systems architecture standpoint, much of the company’s operational design is centered on fast execution and layered security. More than 95 percent of user assets are held in cold wallet storage, which means that they are kept offline and therefore protected from common types of cyberattacks. Two-factor authentication and withdrawal address whitelisting are also part of the standard user security experience. On the backend, the platform boasts utilizing performance infrastructure that is able to handle high rates of transactions with low latency, something paramount in time-sensitive markets.

Regarding transparency, the exchange performs regular proof-of-reserves checks to ensure that user balances are accurately accounted for. These checks have increased in frequency since a series of high-profile trading platform failures in 2022 and 2023 highlighted discrepancies between reserves reported and reserves actually held. Proof-of-reserves has since become a standard for operational responsibility in the digital asset space, providing at least one means for users to assess the solvency and safety of funds.

The company’s focus on user tools is also reflected in how it tackles regulatory compliance. Publically, it asserts that it complies with Know Your Customer (KYC) and Anti-Money Laundering (AML) guidelines in line with international best practices. When asked questions by users about its KYC procedures in 2023, Bitunix released a comprehensive step-by-step of its verification process and reaffirmed that complete verification is compulsory for withdrawals and trading. Though enforcement levels differ by jurisdiction, such assertions are an attempt to preserve confidence among a heterogeneous population of users.

While still quite new, the reputation of the platform has grown. In April 2024, Bitunix won the “Most Trusted Exchange” award at the W2140 World WEB3 Carnival in Kuala Lumpur. While industry awards tend to be viewed as having varying levels of respect, the event itself was populated by a broad range of blockchain experts, and such an award-giving forum can help build credibility, especially among newer customers or those considering multiple exchanges for the first time.

For users, developers, and analysts, Bitunix is a platform that does not just incorporate more than trading. Its product set is engineered to cater to the various types of users, be they technical indicator-oriented, passive income-oriented, or multi-asset tracking-focused. Each piece, from the mobile apps to the performance-based arrangements, is part of an extended toolkit and not an independent feature. With ongoing increases in competition among exchanges, the capacity to sustain that feeling of integrated design might be as crucial as trading volume or geographical coverage.

At the close of 2025, Bitunix stands among the growing number of exchanges attempting to redefine what crypto platforms can offer. Whether through mobile interface innovation, copy trading, or yield-based products, the exchange has structured its development around practical use rather than speculative hype. While its future will no doubt be shaped by regulation, market behavior, and user preference, its emphasis on tool-building over token promotion places it within a segment of the industry that seems focused on long-term infrastructure rather than short-term gains.